fremont ca sales tax calculator

The minimum combined 2022 sales tax rate for Fremont California is. This is the total of state county and city sales tax rates.

Nebraska Sales Tax Small Business Guide Truic

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

. Wayfair Inc affect California. Groceries are exempt from the Fremont and Nebraska state sales taxes. The Fremont sales tax rate is.

To calculate the subtotal amount and sales taxes from a total. Sales tax breakdown fremont details fremont ca is in alameda county. Fast Easy Tax Solutions.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The december 2020 total local sales tax rate was 9250. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Fremont CA.

2022 Cost of Living Calculator for Taxes. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The California sales tax rate is currently 6.

The County sales tax rate is. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The Fremont County Sales Tax is collected by the merchant on all qualifying sales made within Fremont County.

Fremont ne sales tax rate. Groceries are exempt from the Fremont County and Wyoming state. A detailed breakdown of the statewide sales and use tax rate is available.

You can print a 1025 sales tax table here. Real property tax on median home. The sales tax rate is always 925 Every 2020 combined rates mentioned above are the results of California state rate 6 the county rate 025 and in some case.

Local tax rates in California range from 015 to 3 making the sales tax range in California 725 to 1025. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725. The December 2020 total local sales tax rate was 9250.

Did South Dakota v. Fremont in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Fremont totaling 15. The tax rate in your area may be higher than 725 depending on the district taxes that apply there.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. You can find more tax rates and allowances for Fremont and Nebraska in the 2022 Nebraska Tax Tables. The current total local sales tax rate in fremont ca is 10250.

1 state sales tax is 725. California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. California has a 6 statewide sales tax rate but also has 475 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2618 on top.

The Fremont California general sales tax rate is 6. See how we can help improve your knowledge of Math. For tax rates in other cities see California sales taxes by city and county.

The base state sales tax rate in California is 6. Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below. The Fremont Sales Tax is collected by the merchant on all qualifying sales made within Fremont.

There is no applicable city tax. Every hotel guest in california is required by law to pay the transient occupancy tax except for foreign governmental officials. One of a suite of free online calculators provided by the team at iCalculator.

Look up the current sales and use tax rate by address. The Fremont Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Fremont local sales taxesThe local sales tax consists of a 150 city sales tax. The current total local sales tax rate in Fremont CA is 10250.

Sales Tax State Local Sales Tax on Food. CDTFA-180 Sales Tax Reimbursement Schedule 7375. The minimum combined 2021 sales tax rate for fremont california is 1025.

Consequently what is Fremont tax. These taxes will go to the california. Province of Sale Select the province where the product buyer is located.

Fremont California and San Jose California. CDTFA-180 Sales Tax Reimbursement Schedule 750. The Fremont County Wyoming sales tax is 500 consisting of 400 Wyoming state sales tax and 100 Fremont County local sales taxesThe local sales tax consists of a 100 county sales tax.

CDTFA-180 Sales Tax Reimbursement Schedule 725. The Fremont Nebraska Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Fremont Nebraska in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Fremont Nebraska. The current total local sales tax rate in fremont ne is 7000the december 2020 total local sales tax rate was also 7000.

Ad Find Out Sales Tax Rates For Free. Ensure that the Find Subtotal before tax tab is selected. The 1025 sales tax rate in Fremont consists of 6 California state sales tax 025 Alameda County sales tax and 4 Special tax.

The fremont sales tax rate is 0. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Rest of the in-depth answer is here.

39812 Mission Blvd Suite 206 Fremont Ca 94539 Phone 59-510-413-7046. CA Sales Tax Rate. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property.

The California sales tax rate is currently.

California Paycheck Calculator Smartasset

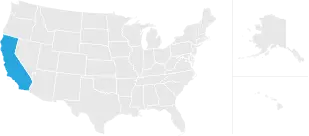

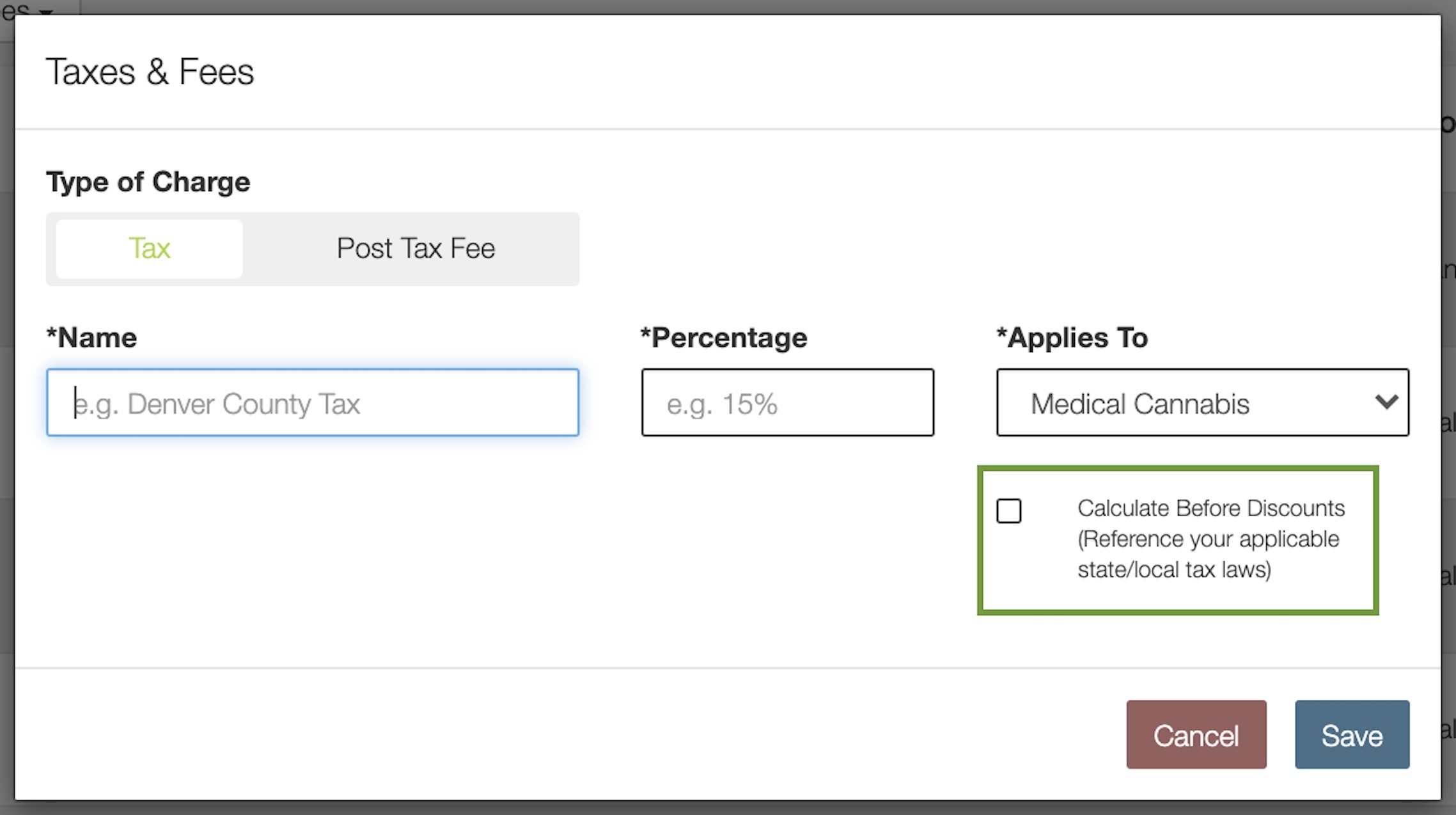

How To Calculate Cannabis Taxes At Your Dispensary

How To Use A California Car Sales Tax Calculator

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Food And Sales Tax 2020 In California Heather

How To Calculate Cannabis Taxes At Your Dispensary

If You Make 150k Per Year In California What Percent Of That Money Goes To Taxes Quora

Calculate Import Duties Taxes To United States Easyship

Why Households Need 300 000 To Live A Middle Class Lifestyle

Understanding California S Property Taxes

How To Calculate Cannabis Taxes At Your Dispensary

California Sales Tax Rates By City County 2022

Calculate Import Duties Taxes To United States Easyship

California Vehicle Sales Tax Fees Calculator

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

If You Make 150k Per Year In California What Percent Of That Money Goes To Taxes Quora

8 25 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

Why Households Need 300 000 To Live A Middle Class Lifestyle